XRP Price Prediction: Can Bulls Push to $4 Amid Technical and Fundamental Crosscurrents?

#XRP

- Technical Momentum: MACD remains bullish but requires consolidation above $3.10 for sustained upward movement

- Regulatory Clarity: SEC case resolution provides foundation but ETF approvals are the next catalyst needed

- Market Sentiment: Mixed signals between institutional interest (ETFs) and whale selling activity creating volatility

XRP Price Prediction

Technical Analysis: XRP Faces Key Resistance at $3.10

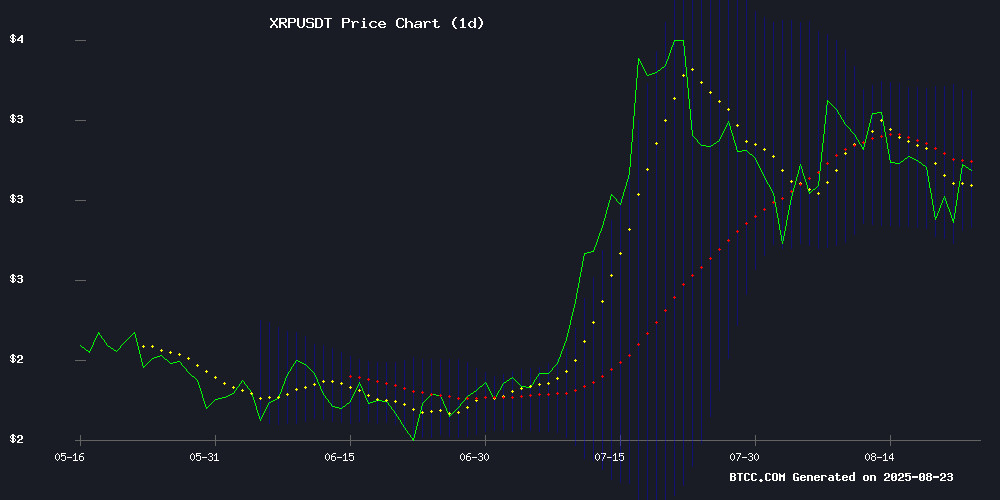

XRP is currently trading at $3.059, slightly below its 20-day moving average of $3.096, indicating potential short-term resistance. The MACD reading of 0.0752 shows bullish momentum, though the signal line at 0.0265 suggests some consolidation may occur. Bollinger Bands indicate volatility with upper resistance at $3.358 and support at $2.834. According to BTCC financial analyst Olivia, 'XRP needs to break above the $3.10 level convincingly to target higher resistance zones.'

Market Sentiment: Mixed Signals Amid Regulatory Developments

Recent news presents a complex picture for XRP. Positive developments include multiple ETF filings and Ripple's partnership with SBI Holdings for a Japan stablecoin launch. However, whale sell-offs and temporary retreat below $3.00 create near-term uncertainty. BTCC financial analyst Olivia notes, 'The dismissal of the SEC appeals removes a major overhang, but ETF approval timelines remain crucial for sustained momentum above $4.'

Factors Influencing XRP's Price

XRP ETF Filings Surge as Seven Asset Managers Press SEC for Approval

The push for a spot XRP ETF has intensified with seven major asset managers—Grayscale, Bitwise, Canary, CoinShares, Franklin Templeton, 21Shares, and WisdomTree—submitting updated S-1 filings to the SEC. The coordinated effort signals strong institutional demand for XRP-based investment products.

With an October deadline looming, analysts interpret the filings as direct responses to SEC feedback. Key revisions include flexible share creation and redemption options, aligning with regulatory preferences. "This collective action is highly notable," says ETF expert Nate Geraci, suggesting a unified industry push could sway the SEC's decision.

Ripple Partners With SBI Holdings to Launch RLUSD Stablecoin in Japan by 2026

Ripple has forged a strategic alliance with SBI Holdings to introduce its RLUSD stablecoin to the Japanese market by Q1 2026. The memorandum of understanding, signed on August 22, designates SBI VC Trade as the exclusive distribution partner for Ripple's enterprise-grade stablecoin. As Japan's first licensed Electronic Payment Instruments Exchange Service Provider, SBI VC Trade is uniquely positioned to facilitate this regulated rollout.

The RLUSD stablecoin, backed by US dollar reserves and short-term government securities, targets institutional demand with monthly third-party attestations for transparency. Currently representing $667 million of the $274 billion global stablecoin market, RLUSD aims to capitalize on projected trillion-dollar growth through its compliance-focused framework.

"This partnership underscores our commitment to regulated market expansion," said Jack McDonald, Ripple's Senior VP of Stablecoins. The move strengthens SBI's crypto leadership in Japan while advancing Ripple's institutional stablecoin strategy amid intensifying competition in the digital asset sector.

XRP Holds $2.70 Support as Gemini IPO Fuels Liquidity Shift

XRP's market trajectory in 2025 hinges on the $2.70 support level, a psychological battleground for traders and long-term investors. A break below this threshold could see prices slide toward the 200-day moving average near $2.45, while a rebound above $3.10-$3.30 resistance may reignite bullish momentum. On-chain data reveals a significant accumulation wall at $2.81, where 1.7 billion XRP were previously purchased, potentially stabilizing prices if selling pressure subsides.

Technical indicators paint a mixed picture. The RSI at 35.8 nears oversold territory, while the MACD remains bearish. Whale activity adds complexity—470 million XRP ($1.35B) were offloaded by large holders between late July and early August, yet mid-tier whales continue accumulating. Ripple's expanding liquidity services and Gemini's planned IPO underscore XRP's growing role as a bridge between traditional and digital finance.

SEC vs Ripple: Court Approves Joint Stipulation of Dismissal, Fund Managers Rush to Update Spot XRP ETFs

The United States Court of Appeals for the Second Circuit has officially approved the joint stipulation of dismissal in the long-running legal battle between Ripple Labs and the SEC. The order, issued on August 22, 2025, marks the definitive end to the lawsuit filed by the SEC in late 2020. Market participants greeted the resolution with relief, as it removes a key regulatory overhang for XRP and the broader cryptocurrency industry.

Institutional investors reacted swiftly to the clarity. At least seven asset managers, including industry leader Graysvale Investment, updated filings for spot XRP ETFs ahead of an October deadline. The flurry of amended S-1 submissions suggests active engagement with regulators. "The synchronized updates indicate constructive dialogue between issuers and the SEC," observed ETF analyst James Seyffart.

XRP Retreats Below $3.00 Amid Whale Sell-Offs and ETF Uncertainty

XRP has fallen below the psychologically significant $3.00 mark, trading near $2.85–$2.90 with a 3.68% decline in the past 24 hours. Daily trading volume edged up slightly to $6.85 billion, but underlying market dynamics suggest growing bearish sentiment.

Whale wallets holding 10–100 million XRP have offloaded approximately 470 million tokens over the last 10 days, reducing cumulative holdings to 7.63 billion. This profit-taking follows XRP's mid-August peak above $3.39 and signals institutional caution about near-term upside potential.

The sell pressure coincides with mounting regulatory uncertainty surrounding ETF applications, creating headwinds for retail investors. Market structure appears fragile as whale exits typically precede extended corrections without aggressive new buying support.

Second Circuit Court Dismisses Ripple-SEC Appeals, Ending Four-Year Legal Battle

The US Court of Appeals for the Second Circuit has officially dismissed the appeals in the landmark case between Ripple and the Securities and Exchange Commission (SEC). The mandate, issued on Aug. 22, marks the conclusion of a four-year legal saga that began with the SEC's 2020 lawsuit alleging Ripple conducted an unregistered securities offering through XRP sales.

XRP's price showed muted reaction, rising less than 1% to $3.0694 following the news. The settlement confirms XRP will not be classified as a security—a significant victory for Ripple and the broader crypto industry. Legal costs will be borne separately by both parties.

Ripple's Chief Legal Officer Stuart Alderoty framed the resolution as closing a contentious chapter that had cast uncertainty over crypto markets. The outcome aligns with other successful SEC settlements by crypto firms like Coinbase, while bolstering prospects for XRP-related financial products.

XRP Price Prediction: Targeting $4.00-$6.00 in August 2025 Despite Mixed Technical Signals

XRP's price trajectory is drawing attention as analysts project a surge to $4.00-$6.00 by late August 2025. This bullish outlook persists even as short-term momentum indicators flash cautionary signals. Market participants appear to be discounting the current bearish technicals in favor of macro-level optimism.

The divergence between price action and sentiment reflects growing institutional confidence in Ripple's legal clarity and cross-border payment adoption. Traders are positioning for a potential breakout, with some drawing parallels to XRP's historical volatility cycles. Liquidity patterns suggest accumulating interest around the $0.50-$0.60 support zone.

XRP Price Faces Pivotal Moment as New Payment Token Emerges

XRP's price trajectory remains a battleground for analysts, with targets ranging from $5-$10 contrasting with current resistance at $2.85-$2.95. The TD Sequential indicator flashes a buy signal on hourly charts, suggesting potential upside, while on-chain data reveals whales diversifying into early-stage utility tokens.

A new payment solution token has crossed $20 million in funding and secured its first major exchange listing, attracting investors seeking tangible utility over speculation. Market participants increasingly favor projects addressing real financial friction, as evidenced by capital rotation from speculative assets to working products.

XRP Price Forecast: Bearish Signals Dominate but $3.41 Target Remains Viable

XRP faces sustained downward pressure, trading below the 9-day exponential moving average at $2.8755 as it tests crucial support near $2.78. Technical indicators paint a bearish picture—the RSI hovers at 42 while MACD histograms show deepening negative values—yet Elliott Wave theory suggests potential for reversal.

The cryptocurrency walks the lower Bollinger Band at $2.777, a pattern typically signaling trend continuation. Resistance now crystallizes between $2.93 and $3.08, with the 20-day SMA at the upper boundary. A daily close above $2.93 could ignite momentum toward the $3.41 target, though market participants anticipate strong selling pressure at higher levels.

Critical support zones emerge at $2.72-$2.70 if current levels fail. The market structure since late July shows consistently lower highs, reflecting diminished buying interest after summer's rally. Traders await either a decisive breakdown or confirmation of accumulation at these levels.

XRP Price Prediction: Analyst Eyes $3.30 Breakout as TD Sequential Signal Flips Bullish

XRP's price hovers near $2.86, testing resistance at $3.06 after a 13% surge fueled by Ripple's RLUSD stablecoin launch. Crypto analyst Ali Martinez highlights a TD Sequential buy signal on hourly charts—a tool historically linked to reversals when market conditions align.

The $2.80–$2.85 demand zone now acts as critical support, with traders watching for a decisive break above $3.06 to confirm upward momentum. While the indicator bolsters bullish sentiment, its mixed reliability in varying market conditions warrants caution.

XRP News: XRPL Hub Upgrade Coming Next Week, Says Ripple CTO

Ripple's Chief Technology Officer David Schwartz has announced a critical upgrade to the XRP Ledger (XRPL) hub, slated for release as early as next week. The enhancement aims to bolster network stability by maintaining node connectivity during high-traffic periods.

Schwartz, a key architect of XRP, has been stress-testing the hub server for three days, observing consistent performance with latency under 33 milliseconds—well within acceptable thresholds. The upgrade reinforces XRPL's reputation for reliability, a cornerstone of its value proposition since 2012.

Will XRP Price Hit 4?

Based on current technical indicators and market developments, reaching $4 in the near term appears challenging but possible with specific catalysts. The price needs to overcome several resistance levels:

| Resistance Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $3.10 | 20-day MA level |

| Key Resistance | $3.30-$3.41 | Technical and psychological barrier |

| Target Zone | $3.80-$4.00 | Next major resistance area |

BTCC financial analyst Olivia suggests that 'ETF approvals and sustained institutional interest would be necessary drivers for a push toward $4, likely requiring 2-4 weeks of favorable conditions.'